If you’ve shopped around for 401(k) providers, then you have probably been comparing plans and evaluating fees. The harsh truth is that many 401(k) providers are either charging for fees that they shouldn’t, or they are simply overcharging.

Continue readingMost Millionaires Built Their Wealth With a 401(k)

“The fact that the average millionaire didn’t go to an elite school is great news for many Americans who can’t afford an expensive education. The state university or community college can provide a solid foundation for the future. You don’t need a prestigious diploma to win with money.” – Chris Hogan

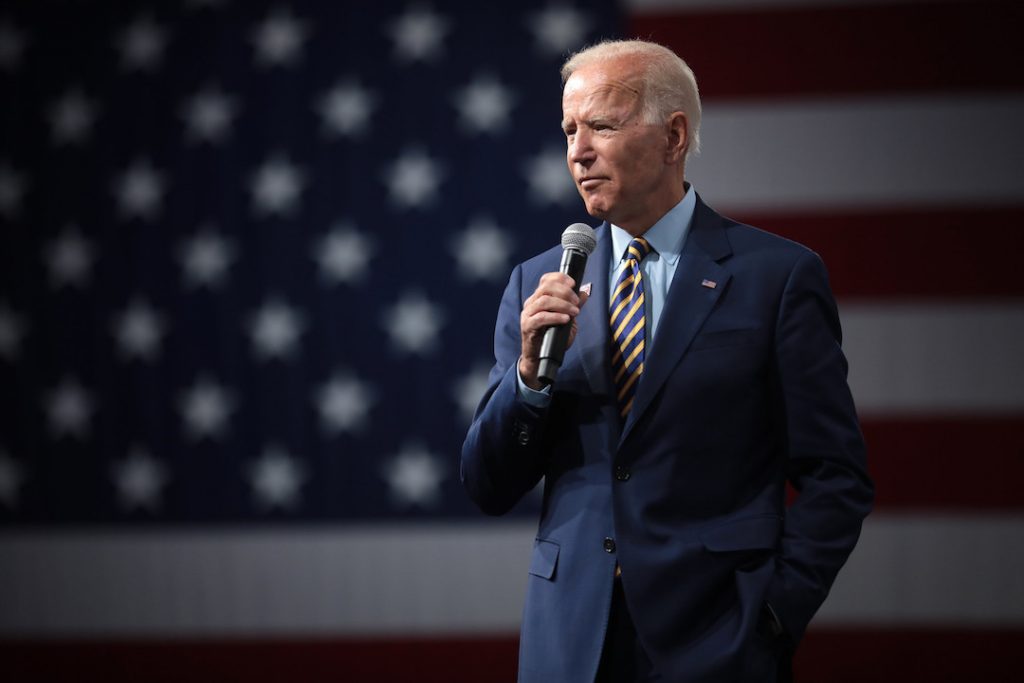

Continue readingBiden Wants to Change 401(k)s as We Know Them; Is That Good?

Presidential candidate Joe Biden is proposing a critical change to employer-sponsored 401(k) plans: giving everyone a percentage tax credit based on how much they contribute.

Continue readingPulling From Your 401(k) During The Pandemic

Here’s what you need to know about repaying a coronavirus-related 401(k) distribution.

Continue readingSmall 401(k) Plans Cost More Than Large 401(k) Plans…

…and it’s preposterous!

Plans with fewer assets are charged more for managing/administering a 401(k) than plans with more assets, according to data from the 401k Averages Book 19th Edition. And, that is not the only driver for cost disparity. Even plans with similar account balances may be charged differently.

Continue reading401(k) Fees Eat Your Retirement; Here’s What You Can Do About It

Did you know that almost 40% of 401(k) participants believe they don’t pay fees; about 20% didn’t even know there were fees associated with their 401(k); and, about 15% don’t understand how fees are calculated. Yet, nearly every 401(k) provider charges fees. So, how do you determine what fees you are paying, and how much those fees cost you in retirement?

Continue readingNondiscriminatory Testing of 401(k) Plans

Nondiscriminatory testing is often performed on behalf of plan sponsors by the record-keeper or a third-party administrator (TPA). However, it is vital that plan sponsors understand the basics of the testing. For example, what types of contributions are tested, how the test is conducted and what happens when a plan fails.

Continue readingSinking in 401(k) Fees? Here’s What You Can Do

Most surveys that poll 401(k) participants have “no idea” if their investments are “good, bad, or ugly.” And, when you are planning for retirement, you want to know that the funds you are investing are generating wealth and not just sucking money out of your account due to hidden or overpriced fees.

Continue reading4 Effective Ways to Improve 401(k) Employee Participation

Offering a 401(k) plan to employees is one of the most compelling benefits to attract and retain your employees. However, if your staff is not participating in the company-sponsored 401(k) plan, the perceived value is zilch!

Continue readingTraditional 401(k) Versus Roth 401(k) – What’s The Difference?

When it comes to selecting between a Traditional 401(k) vs. a Roth 401(k), you may be wondering which is the better choice. Both are great retirement vehicles, but they do differ. Here are a few points to consider when selecting between a Traditional or Roth 401(k).

Continue reading