Form 5500 is a crucial reporting requirement for employee benefit plans, providing valuable insights into their financial health and operations. It’s important to understand the different types of Form 5500 and the specific eligibility criteria set by the IRS. In this post, we will explore the Long-Form, Short-Form (SF) and EZ versions of Form 5500, clarifying who is eligible for each one based on IRS criteria. This knowledge will help ensure compliance and simplify your reporting obligations. Questions about the Form 5500? Check out our Form 5500 FAQs here.

Types of Form 5500 and Eligibility Criteria:

- Long-Form (Form 5500):

The Long-Form version of Form 5500 is a comprehensive report designed for larger plans or those with complex features. It asks for detailed information about your plan’s operations, including financial statements and attachments. By providing a complete picture of your employee benefit plan, the Long-Form helps meet regulatory requirements, maintain transparency, and facilitate thorough reporting. It is required for plans with 100 or more participants at the beginning of the plan year.

- Short-Form (SF) or Form 5500-SF:

The Short-Form, also known as Form 5500-SF, is a simplified reporting option for small plans. It reduces the reporting process by eliminating certain schedules and attachments required in the Long-Form. The short-Form focuses on essential plan information, ensuring compliance while easing the reporting burden. It is suitable for plans with fewer than 100 participants at the beginning of the plan year, offering a simpler approach to meet reporting obligations.

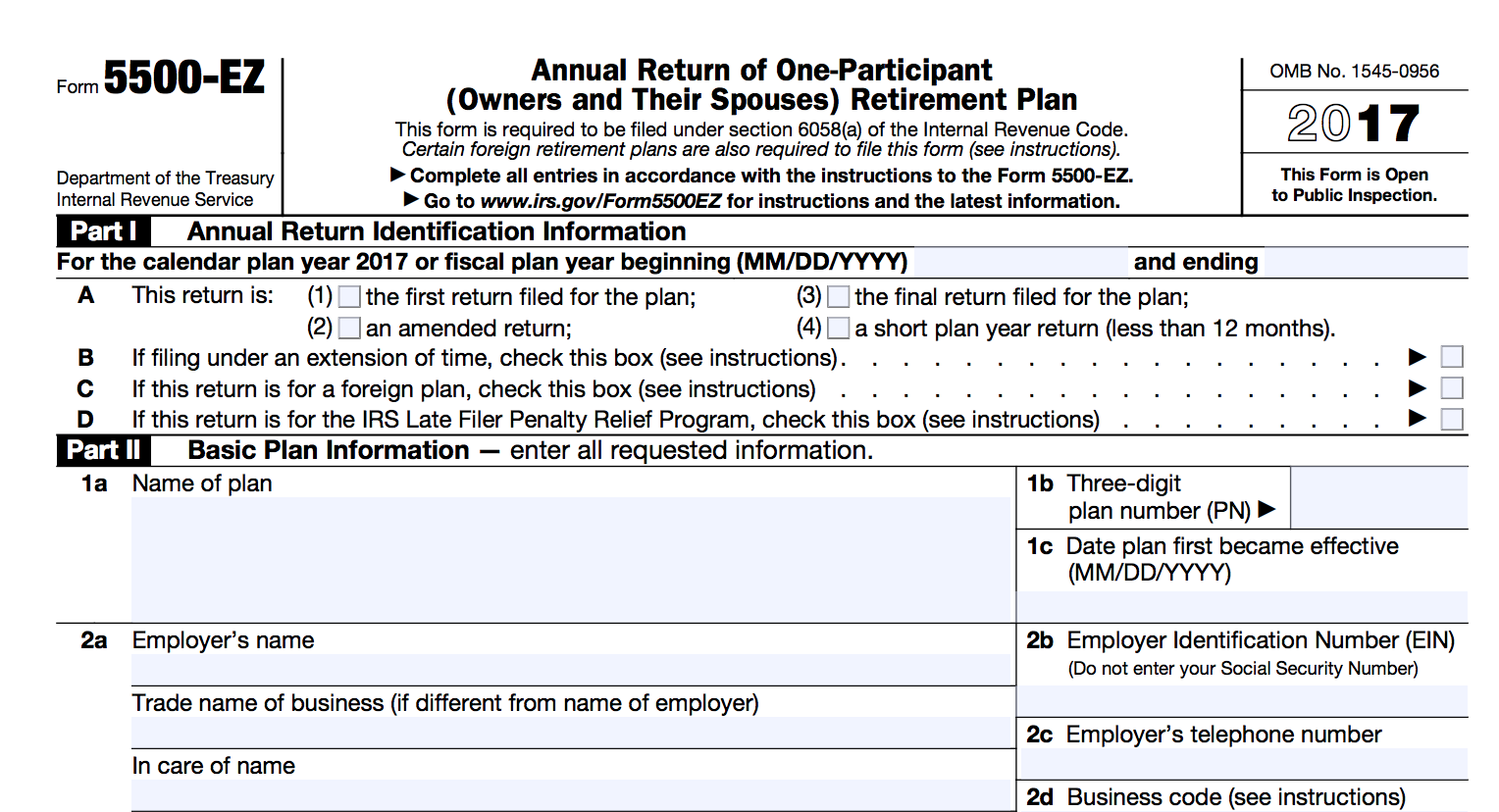

- EZ or Form 5500-EZ:

Form 5500-EZ, also called the EZ version, is the simplest reporting option. It is specifically designed for one-participant plans or plans with no participants such as individual 401(k) plans or certain foreign plans. The EZ version requires minimal information, making it a straightforward choice for small plans with simple structures. It offers an easy and streamlined process for eligible plans to meet their reporting obligations.

Navigating the nuances of Form 5500 and understanding the eligibility criteria for each version is crucial for accurate and compliant reporting. Saveday, as your trusted 401(k) provider, can give expert guidance and support throughout the process. Our experienced team will help determine the appropriate form based on your plan’s characteristics, ensuring compliance and simplifying your reporting obligations.

Want to learn more about how saveday can simplify Form 5500? Discover your simplified options here!