2021 is almost here! And, as the holiday season approaches, don’t forget about contributing to your 401(k).

Continue readingShould I Open A 401(k) If My Employer Doesn’t Match?

You may be wondering, “What’s the point of opening a 401(k) if my employer doesn’t match?” Here are four reasons why you should consider participating in a 401(k).

Continue readingWhat To Expect When Starting A 401(k) Plan

Taking the next step in your business and establishing a 401(k) may have you wondering, “What’s involved with setting up a 401(k)?” You are not alone.

Continue readingDebunking 4 Myths Surrounding Small-Business 401(k) Plans

Considering opening a 401(k) plan for your business, but concerned about the process or qualifications? Fear not. We’re debunking some of the top myths surrounding small business 401(k) plans and why you shouldn’t let these myths stand in the way of you or your employees’ retirement planning goals.

Continue reading3 Things You Should Know About A Traditional 401(k)

Generally speaking, the more money you make, the more of an incentive it is for you to contribute to your 401(k) since you will save more in taxes by contributing. It should be noted however that contributing to a 401(k) regardless of your income level will still help you save money on taxes.

Continue reading401(k) Fees Are A Thing Of The Past

If you’ve shopped around for 401(k) providers, then you have probably been comparing plans and evaluating fees. The harsh truth is that many 401(k) providers are either charging for fees that they shouldn’t, or they are simply overcharging.

Continue readingMost Millionaires Built Their Wealth With a 401(k)

“The fact that the average millionaire didn’t go to an elite school is great news for many Americans who can’t afford an expensive education. The state university or community college can provide a solid foundation for the future. You don’t need a prestigious diploma to win with money.” – Chris Hogan

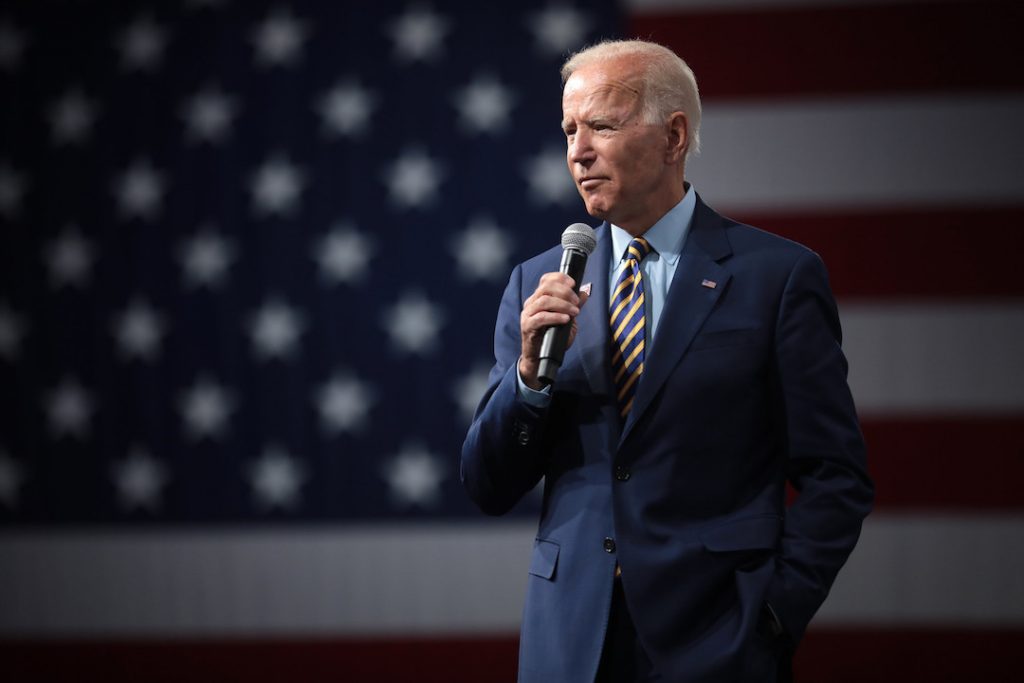

Continue readingBiden Wants to Change 401(k)s as We Know Them; Is That Good?

Presidential candidate Joe Biden is proposing a critical change to employer-sponsored 401(k) plans: giving everyone a percentage tax credit based on how much they contribute.

Continue readingPulling From Your 401(k) During The Pandemic

Here’s what you need to know about repaying a coronavirus-related 401(k) distribution.

Continue readingSmall 401(k) Plans Cost More Than Large 401(k) Plans…

…and it’s preposterous!

Plans with fewer assets are charged more for managing/administering a 401(k) than plans with more assets, according to data from the 401k Averages Book 19th Edition. And, that is not the only driver for cost disparity. Even plans with similar account balances may be charged differently.

Continue reading