Paying off debt while saving for retirement is entirely possible – you don’t need to choose one over the other. So, go ahead and invest while paying off your debt – you won’t regret it.

Continue reading3 401(k) Strategies To Implement In 2021

Implementing these 3 strategies now to optimize your savings can help you achieve your retirement goals.

Continue readingAre You Overlooking a Key Employee Benefit?

Despite 87% of job seekers saying that a 401(k) plan is a “must-have” benefit for them, nearly 40 million working Americans don’t have access to an employer-sponsored retirement plan.

Continue readingPlanning For Retirement In Your 50s? Here Are 3 Things You Should Know

As you start to near retirement in your 50s, it’s more important than ever to evaluate your retirement plan and think about what your financial future looks like. If you haven’t started planning your retirement yet, here are some important things you should know.

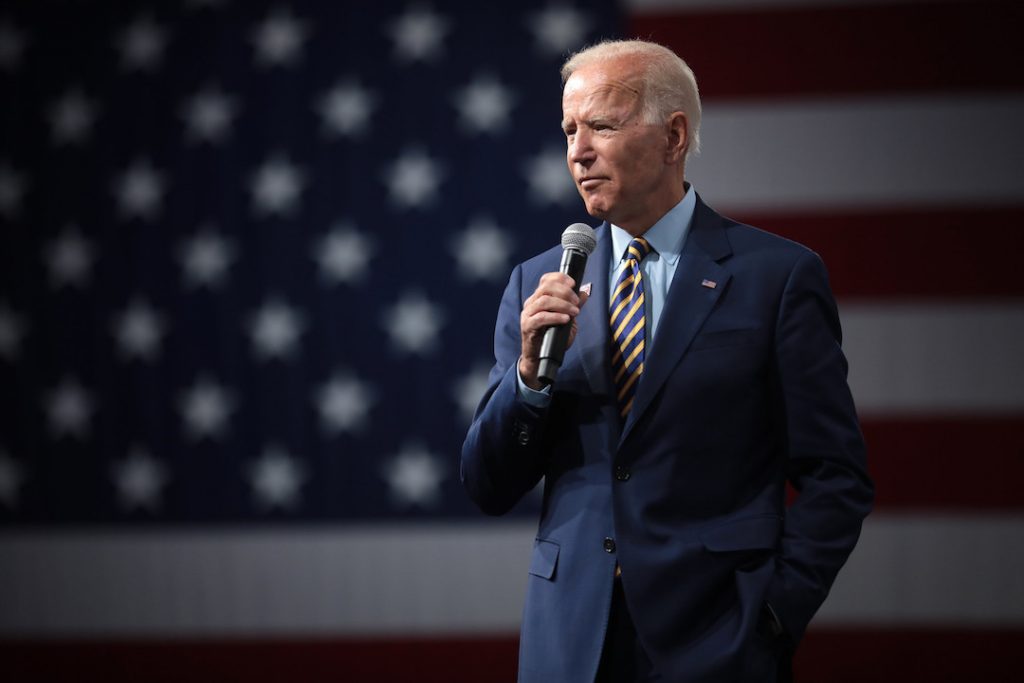

Continue readingBiden Wants to Change 401(k)s as We Know Them; Is That Good?

Presidential candidate Joe Biden is proposing a critical change to employer-sponsored 401(k) plans: giving everyone a percentage tax credit based on how much they contribute.

Continue reading401(k) Fees Eat Your Retirement; Here’s What You Can Do About It

Did you know that almost 40% of 401(k) participants believe they don’t pay fees; about 20% didn’t even know there were fees associated with their 401(k); and, about 15% don’t understand how fees are calculated. Yet, nearly every 401(k) provider charges fees. So, how do you determine what fees you are paying, and how much those fees cost you in retirement?

Continue readingThe Thirties: When Adulting Gets Real

Investing can start at any age, and starting when you are younger help you achieve your goals, and setting these 3 investment goals in your 30s will help you plan for a better tomorrow.

Continue reading